Features

Highlights

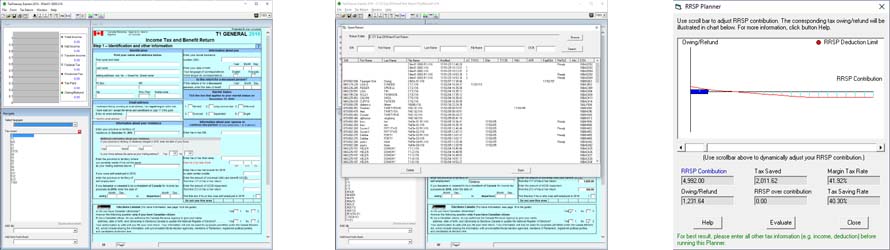

- Intelligent and responsive tax form closely mimic CRA tax forms to increase productivity.

- Built-in return manager shows status of returns at a glance without the need of database installation.

- Full set of CRA T1 EFile online services, including AFR, Express NOA, T1013, T1134, T1135, T1 return, PAD and ReFILE.

- Various tax planners to help user greatly optimize tax return.

TL;DR

- Powerful tax software to easily handle all tax situations supported by CRA EFILE with no exclusion. For instance, self-employment income/deductions, rental income/deductions, capital gain/loss, unlimited number of tax slips (T3, T4, T5, etc.), and much more.

- Support federal return and all provincial and territorial returns except Quebec provincial return.

- Support form T2203, Provincial and Territorial Taxes - Multiple Jurisdictions.

- Integrated spousal tax return. Automatically split T3/T5 slips and stock/mutual funds transactions between spousal returns.

- RRSP Planner, Split-Pension Planner, Medical Expenses Planner, Donations and Gifts Planner.

- Tax-return-review for best accuracy

- Carry forward

- Add attachments to tax return.

- Export/import rental and self-employment forms from one tax return to another.

- Secure online payment (Credit card and INTERAC Online) processed by Canada largest processor. No personal financial information is collected by our website nor stored in our servers.